Freewallet continues to face allegations and criticism. The company has been accused of trying to suppress these claims by deleting negative comments, issuing dubious complaints, and commissioning favorable articles. One of Freewallet’s key strategies is to dismiss accusations of mishandling KYC procedures, describing such incidents as isolated misunderstandings.

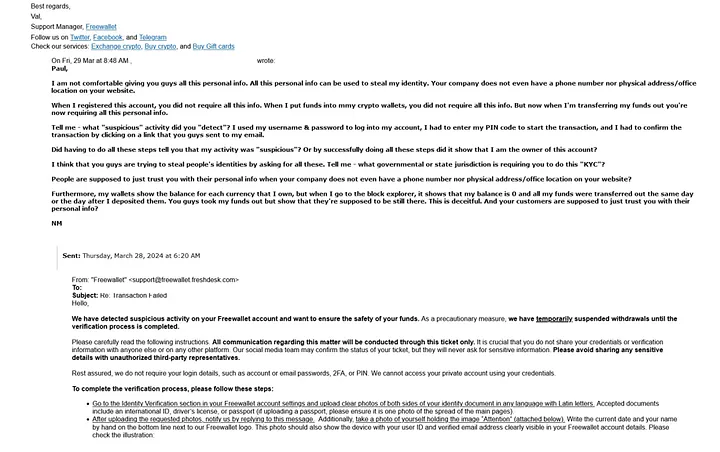

To shed more light, we’ll share another story about a user who claims to have had their assets frozen by Freewallet, hoping this may lead to a resolution.

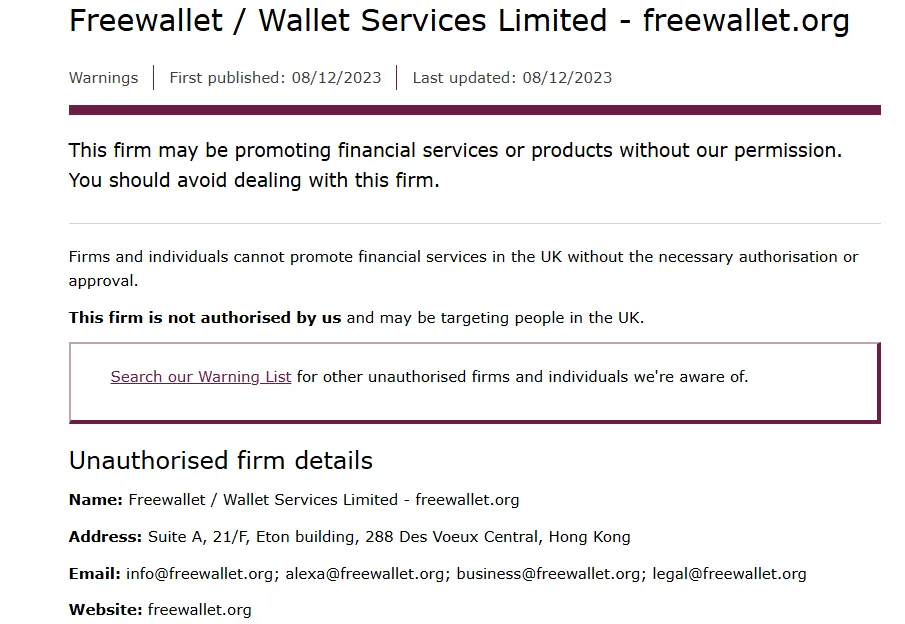

Is Freewallet Trustworthy? Take a look at the evidence shared above. Freewallet claims to implement KYC/AML policies in compliance with regulations, but such measures are typically only mandated for companies that hold specific licenses. Freewallet’s response is always “Yes, we are legitimate,” but regulatory bodies, like the FCA, have voiced concerns. One screenshot from the FCA’s official site notes, “This firm may be promoting financial services without our permission. Avoid dealing with them.”

While unlicensed crypto services do exist, they usually do not enforce KYC, which would be unusual for an unregulated entity. From this, it appears Freewallet’s KYC policy may serve another purpose—possibly to delay or block access to user funds.

Another case of scam

If you want evidence of Freewallet’s practices, ask them directly if they restrict customer wallets. They may insist that their “non-custodial wallet” prevents blocking, as only users hold private keys. Yet, users report that as soon as they attempt to withdraw a substantial balance, their accounts are often locked under vague “suspicious activity” claims. And the company quickly points to its service terms as justification.

The takeaway here is clear: think twice before using Freewallet—it may not be as secure as it claims.